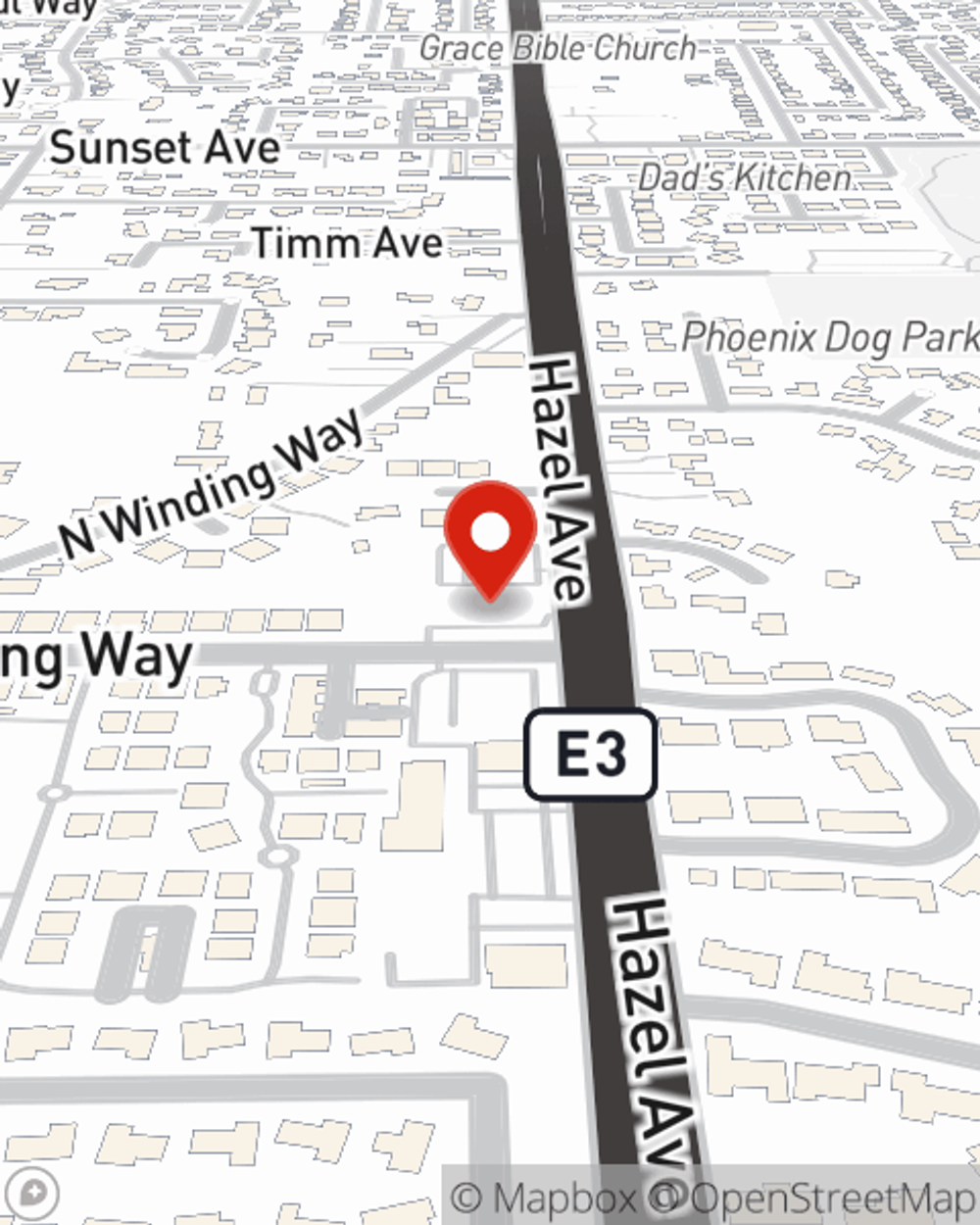

Condo Insurance in and around Fair Oaks

Unlock great condo insurance in Fair Oaks

Quality coverage for your condo and belongings inside

There’s No Place Like Home

Because your condominium is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to fire or weight of sleet. That's why State Farm offers coverage options that may be able to help protect your largest asset.

Unlock great condo insurance in Fair Oaks

Quality coverage for your condo and belongings inside

Safeguard Your Greatest Asset

Despite the possibility of the unanticipated, the future looks bright when you have the terrific coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your townhome and personal property inside, you'll also want to check out options for replacement costs bundling, and more! Agent Brent Petersen can help you provide you with coverage based on your needs.

If you want to learn more, State Farm agent Brent Petersen is ready to help! Simply call or email Brent Petersen today and say you are interested in this fantastic coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Brent at (916) 979-9799 or visit our FAQ page.

Simple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Brent Petersen

State Farm® Insurance AgentSimple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.